Spotlight on scams that target older adults

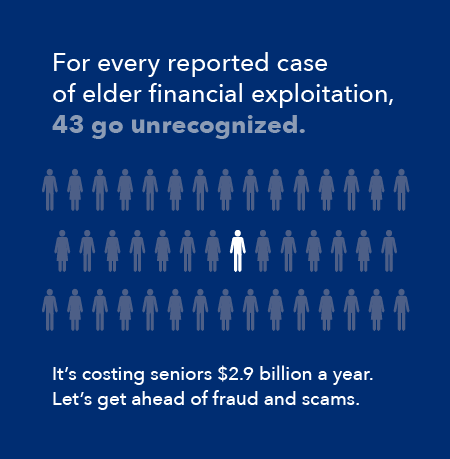

Older Americans lose an estimated $2.9 billion annually to financial exploitation, and it’s estimated that for each case that is reported, 43 others go unrecognized. With 50 million older people in this country, and 10,000 more reaching retirement age every day, we cannot afford financial predators or practices that victimize our elder citizens.

Therefore, in honor of World Elder Abuse Awareness Day on June 15, we’re teaming up with the Federal Deposit Insurance Corporation (FDIC) to launch Money Smart for Older Adults – Prevent Financial Exploitation . This program trains-the-trainer to prevent common scams and teaches you to spot other types of elder financial exploitation.

An example of a common scam the training explores is the “grandparent scam .” It’s terrible, and this is how it normally works:

An imposter calls a grandparent pretending to be a grandchild in trouble; the scammer may even know the grandchild’s name. The scammer is usually crying making it hard to recognize the grandchild’s voice. The scammer pleads for the grandparent to immediately wire money and not tell any family members for fear of upsetting them. Many people will immediately jump to the assistance of the grandchild and won’t ask questions until later.

Should you get a call asking for money from a relative in distress, verify that the caller is not an imposter.

- Ask a question that only your loved one can answer.

- Hang up and call the relative’s known phone number.

- Call someone else you trust to verify the story before you send money.

Other potential threats to older Americans’ financial security can come in the form of financial products that are risky, expensive, and inappropriate for their needs. For example, there are companies that target retirees who may need access to cash by offering them lump sum “advances” on their pension payments. These so-called advances are reported to carry interest rates from 27 to 106 percent, threatening many older borrowers’ safe retirement.

Pension advance firms have been targeting military veterans, and reportedly have recently begun targeting teachers, firefighters, and police officers. In the case of veterans, federal law contains a general prohibition on assigning military pensions to a third party. Reports indicate that many firms may try to get around this by calling the lump sum payment a loan or an advance and by urging veterans to deposit their monthly retiree payments in a newly created bank account controlled by the firms, which is then debited to pay back the lenders. Whatever the name, these transactions generally are not a good deal for veterans or other retirees.

Here’s what to do if you are offered a pension advance loan:

- Say no to arrangements that allow a creditor to access the account where you get your benefits.

- Get advice from a trusted financial expert if you need emergency funds. Other arrangements may be less costly.

- Ask CFPB about consumer financial products and advice about other options.

- Tell us your story, and tag your issue “pension advance loan.”

An informed consumer is the first line of defense against abusive practices. Older consumers and their loved ones can learn how to recognize and prevent fraud scams, and other forms of financial exploitation in the Money Smart for Older Adults’ Participant/Resource Guide or request a training for a group from a Money Smart Alliance Partner by emailing the FDIC at communityaffairs@fdic.gov. The FDIC also offers a full range of Money Smart resources .