The CFPB is working to reinforce the foundation of a fair, nondiscriminatory and competitive mortgage market

HMDA Data and Enforcement Actions Reveal Inaccurate Data Reporting Practices

The Home Mortgage Disclosure Act (HMDA) requires mortgage lenders to report data about the loans and applications they receive and the loans they originate. These data allow regulators and the public to assess whether mortgage lenders are meeting the housing needs of their communities.

HMDA can be an effective, quantitative tool for uncovering discrimination, but it cannot work without complete and accurate data. Unfortunately, some lenders fail to report HMDA data, or even intentionally report inaccurate data, despite their obligations under federal law. This harms the entire market, including law-abiding mortgage lenders and families who may be put at risk of illegal discrimination.

The CFPB takes action against lenders providing bad HMDA data

In the last year, the CFPB used its enforcement authority to hold two major lenders accountable for failing to report complete and accurate HMDA data.

- Last week, the CFPB took action to resolve its lawsuit against one of the nation’s largest mortgage lenders, Freedom Mortgage Corporation, for submitting false mortgage lending information to the federal government and for violating a 2019 CFPB order. Under the court order, Freedom Mortgage must pay a $3.95 million civil penalty and regularly audit, test, and correct its HMDA data.

- In November 2023, the CFPB ordered Bank of America to pay a $12 million penalty for routinely failing to ask mortgage applicants certain demographic questions as required by HMDA. Bank of America then falsely reported that the applicants had chosen not to respond.

The CFPB also conducted research and analysis which identified a small group of mortgage lenders and loan originators that fail to report demographic information under HMDA at high rates, a potential indicator of intentional misreporting.1 Mortgage lenders should carefully examine their own reporting practices and HMDA compliance systems to ensure they are monitoring for inaccurate or incomplete data.

HMDA requires lenders to collect accurate demographic information

HMDA and its implementing regulation, Regulation C, generally require mortgage lenders to collect and report applicants' demographic information, among other data points. Most applicants provide this data voluntarily. However, if an applicant declines to do so during an in-person application, the regulation requires the lender to attempt to collect this information through visual observation or by looking at the applicant's surname. For applications not taken in person - such as those made online, by mail, or over the phone - this visual observation requirement doesn't apply. In these cases, if the applicant doesn't provide their demographic information, the lender reports that the "information was not provided by applicant in mail, internet, or telephone application." A lender’s failure to follow these requirements to collect, record and report demographic information constitutes a violation of HMDA and Regulation C.

Outlier institutions report demographic information at abnormally low rates

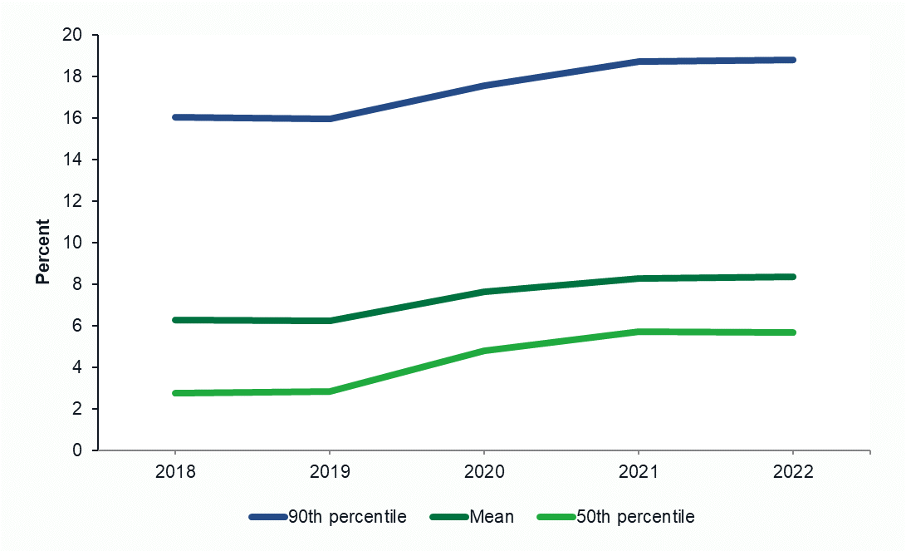

Most applicants provide demographic data voluntarily, or mortgage lenders are otherwise able to report demographic information based on visual observation or the applicant’s surname. Each year, half of institutions include demographic information for 94.3 percent or more of their HMDA records. Three-quarters of lenders reported included demographic information for 88 percent or more of their HMDA records. However, a small number of mortgage lenders fail to report the required HMDA demographic information much more often than others. The worst 10 percent of lenders failed to report demographic information 4.4 times more often, on average, than a lender at the median. High levels of nonreported demographic information could be caused by intentional misreporting, ineffective policies and procedures at the institution level, a lack of monitoring and controls pertaining to loan officer practices, or application interfaces that discourage the collection of demographic information.

Figure 1. Unreported demographic information over time

Note: Only includes HMDA loans and applications that were originated, approved but not accepted, and denied

The institutions with the lowest demographic reporting rates tend to be larger lenders reporting more loans and applications. This means their actions have an outsized impact on HMDA data overall. In fact, 79 percent of the 2018-2022 records without demographic information are reported by these outlier lenders.

Outlier mortgage loan officers fail to report required HMDA data

The CFPB’s analysis of 2018-2022 HMDA data identified thousands of individual loan officers who failed to report required demographic information at egregiously (and implausibly) high rates. In 2022, there were over 7,000 loan officers nationwide that reported that demographic information was “not provided by the applicant” in 95 percent or more of their mortgage applications reported in HMDA. This may represent loan officers who are discouraging applicants from answering demographic questions, or who are intentionally misreporting that applicants decline to answer the questions. It also raises questions about whether the financial institution’s compliance management system is working, if a lender is submitting records with these troubling patterns.

Addressing failures to report HMDA data

We have stepped up efforts to address HMDA compliance comprehensively, including using our enforcement and supervision tools.

We expect lenders to meet their responsibilities, and these enforcement actions are proof that we will hold companies accountable when they don’t. We will continue to focus on this issue in supervisory examinations of mortgage companies, and we will take action where we do find non-compliance.

Employees who they believe their company has violated federal consumer financial protection laws are encouraged to send information about what they know to whistleblower@cfpb.gov.

References

- We limited our analysis to HMDA records expected to have complete demographic information. This includes all applications that were originated, approved but not accepted, or denied. HMDA records where race and ethnicity, or sex are not reported are classified as having nonreported demographic information in this blog post.