Early impacts of removing low-balance medical collections

The three nationwide credit reporting companies removed a large share of medical collections items—tradelines, in industry parlance—from consumers’ credit reports in 2022 and 2023. Specifically, the companies committed to removing medical collections tradelines that were paid, less than one year past due (up from six months previously) or with initial balance less than $500. Medical collections tradelines of less than $500 were removed in April 2023, while the others were removed in July 2022. In a recent report we documented that the share of consumers with a least one medical collections tradeline on their credit report dropped from around 14 percent in March 2022, prior to the changes, to around 5 percent in June 2023, after all the changes went into effect. The vast majority of the removed tradelines were those with initial balances of less than $500. This is on top of a longer-running decline in all collections tradelines on consumer credit reports. Although many medical collections tradelines were removed, the majority of medical collections balances still remain on credit records. In this Spotlight, we take an early look at how the changes to the reporting of medical collections tradelines have affected the financial health of consumers who had medical collections tradelines on their credit records prior to the changes.

We find that:

- There continues to be significant churn in the reporting of medical collections tradelines. About 10 percent of consumers who we expected should have had all medical collections removed due to the changes had acquired new medical collections above $500 by the end of the period studied. At the same time, about a third of consumers who we expected would continue to have medical collections tradelines actually had all medical collections removed during the same period.

- Consumers who had all their medical collections removed saw significant improvements in credit scores. The presence of medical collections on a consumer’s credit report can lower their credit score. Compared to similar consumers who did not have all their medical collections removed, credit scores rose by an average of 20 points. Many consumers saw their credit scores rise enough to put them in a higher credit score tier.

- Removing medical collections has not yet led consumers to seek more credit. While many consumers with medical collections made inquiries for new accounts between April 2023 and August 2023, there was no difference between consumers for whom we would expect all medical collections removed, and those who we would expect to continue to have medical collections reported.

Data and Methodology

We use data from the CFPB Consumer Credit Panel (CCP), a sample of approximately five million de-identified credit records from one of the three nationwide consumer reporting agencies. We focus specifically on consumers who had medical collections on their credit records in December 2022 before the majority of medical collections tradelines were removed, and examine those consumers’ credit records in August 2023, (8 months later) after all the reporting changes were complete. This sample includes about 650,000 consumers in the CCP, corresponding to roughly 31 million consumers in the U.S. as a whole.

Simply looking at changes in credit scores or other outcomes for these consumers would not necessarily capture the effect of the reporting changes. Consumers’ credit scores can change for many reasons, and medical collections tradelines are frequently removed from consumers’ credit records independent of any broader changes by the credit reporting companies. Moreover, CFPB research has shown a general downward trend in the prevalence of medical collections tradelines going back several years prior to the recent reporting changes. To disentangle the effect of the reporting changes from reasons that consumer outcomes may change, we focus in on consumers whose largest medical collections tradeline in December 2022 was just under $500 (and thus we would expect all their medical collections tradelines to be removed) and on consumers whose largest medical collections tradeline was just above $500 (and thus we would expect some of their medical collections tradelines to remain on their credit records). This does not capture the entire effect of the reporting changes, but instead captures one aspect of the changes: The effect of having all medical collections tradelines removed compared to having some or none removed.

We use December 2022 as the baseline because prior CFPB research indicates that medical collections tradelines under $500 began being removed in March 2023, and moreover credit score information in the CCP is only available quarterly (such that there is no score information for February 2023). Just under half our sample of consumers with medical collections tradelines on their credit record in December 2022 had an initial balance of less than $500 on their largest medical collection tradeline.

Most, but not all, consumers with all medical collections tradelines below $500 in December 2022 had no medical collections tradelines in August 2023.

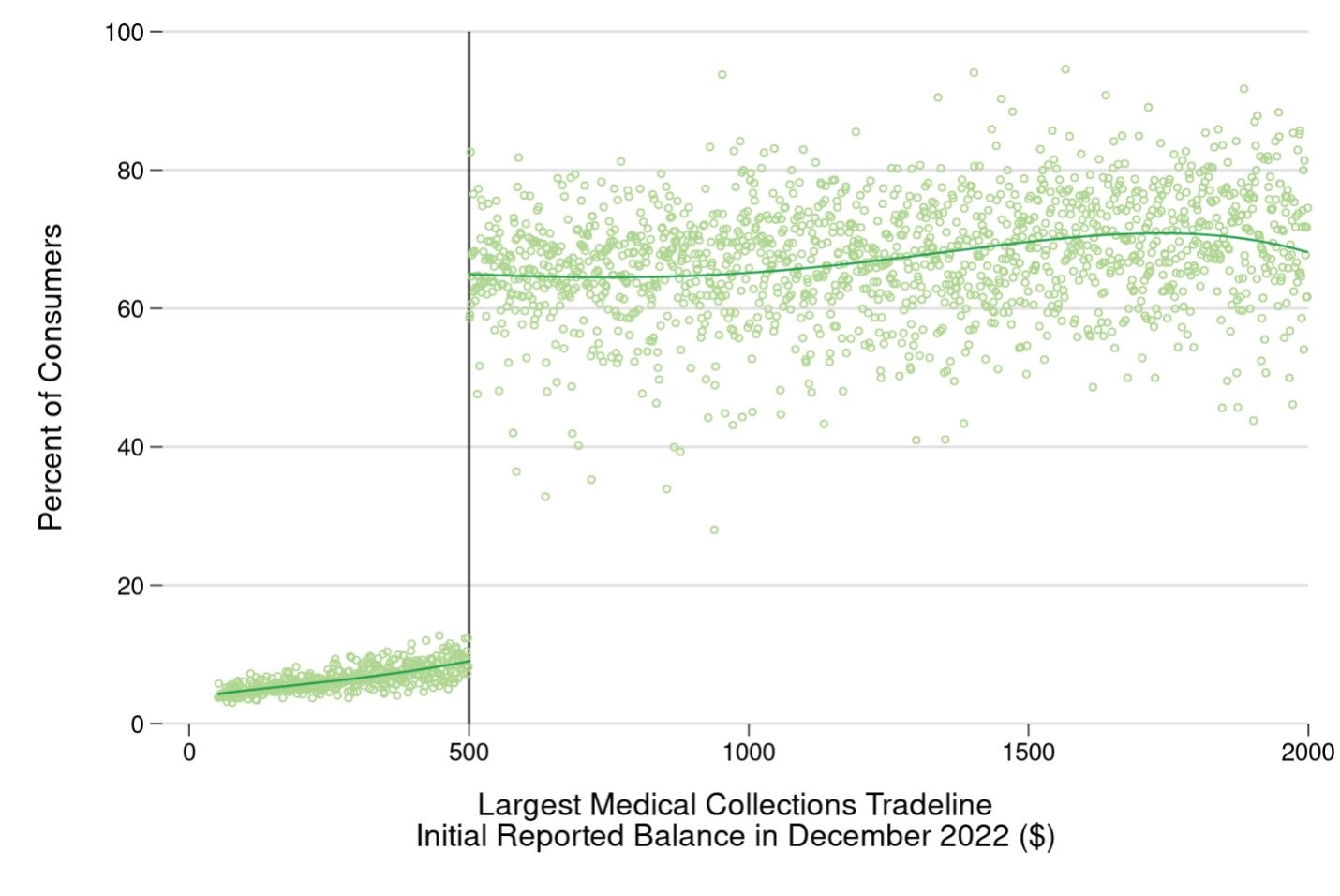

In the figure below, we plot the share of consumers who still had a medical collections tradeline in August 2023, grouped by the value of their largest medical collections tradeline in December 2022. We also plot a flexible best-fit line showing the smoothed average relationship above and below the $500 threshold. Unsurprisingly, there is a clear split that occurs at $500. The vast majority of the consumers whose largest medical collections tradeline had a balance just below this amount did not have any medical collections tradelines on their credit records in August 2023. However, it is also notable that the split is not absolute: Around 10 percent of consumers whose largest December 2022 medical collections tradeline was just under $500 still had at least one medical collections tradeline in August 2023 (necessarily a new medical collection for more than $500). At the same time, while we would expect most consumers whose largest medical collection tradeline was over $500 to continue having at least one medical collection tradeline, in fact only around two-thirds of consumers whose largest medical collections tradeline was greater than $500 still had at least one medical collections tradeline on their credit records in August 2023.

This is consistent with previous CFPB research showing that medical collections tradeline reporting is characterized by a huge amount of churn, with these collections tradelines rapidly falling off of consumers’ credit reports but being replaced by other medical collections tradelines. Sometimes this churn is due to the same debt being re-assigned to another debt collector, and furnishers can vary in how long they continue reporting. However, even when following the same original medical debt across collectors, prior to the reporting changes it was common for as much as a quarter of all medical collections tradelines to be removed from consumers’ credit reports within 6 months of first being added, and medical collections tradelines with an initial balance above $500 were removed faster than those with an initial balance below $500. For context, the Fair Credit Reporting Act generally imposes a limit of seven years from the date of delinquency for negative information like collections to be reported. Even prior to the reporting changes, the majority of medical collections tradelines were typically removed much sooner than seven years.

Figure 1: Share of consumers with at least one medical collections tradeline on their credit records in August 2023, by amount of largest initial reported medical collections tradeline in December 2022.

Source: CFPB Consumer Credit Panel

Credit scores improved for consumers who were likely to have all medical collections tradelines removed

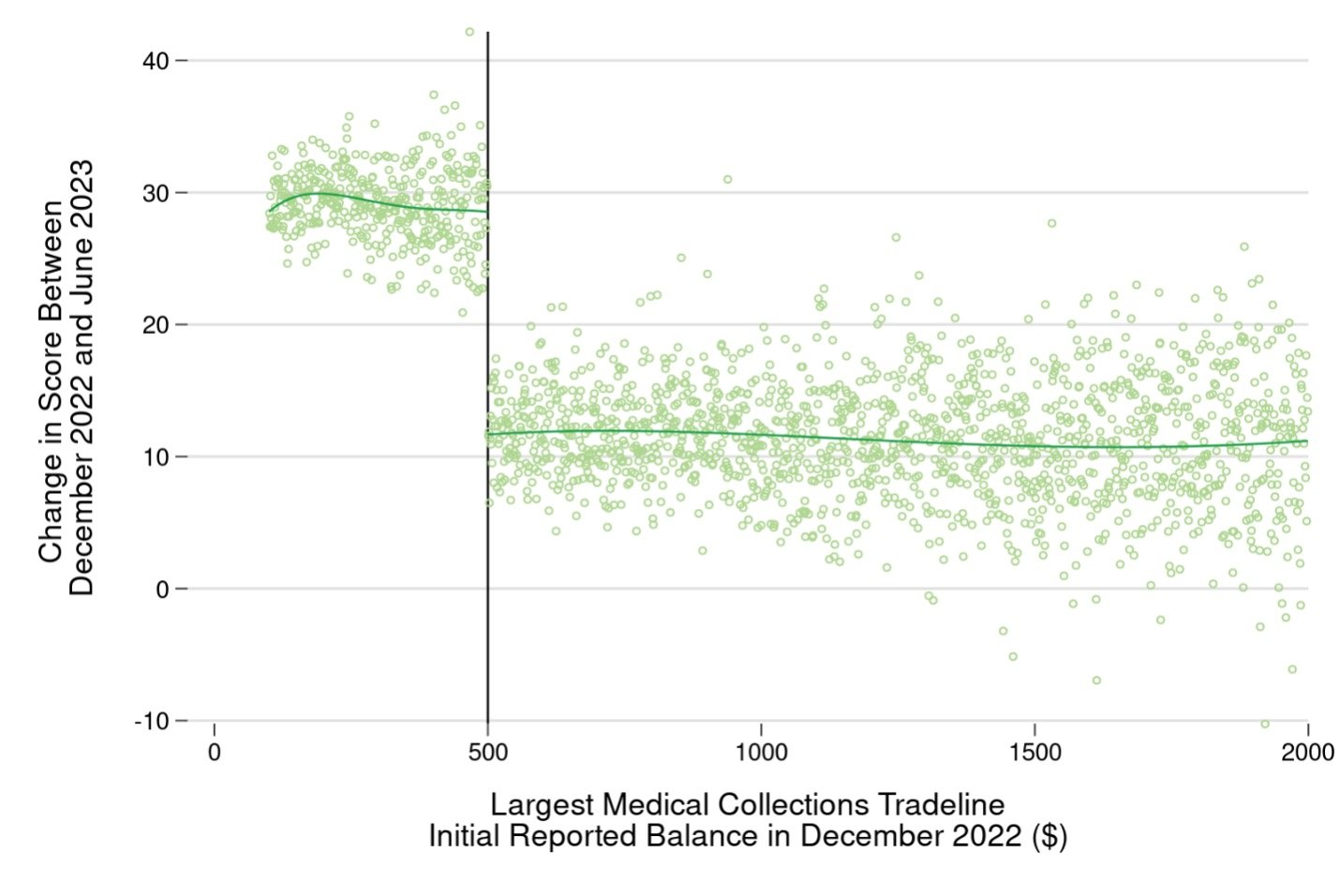

Turning now to consumer outcomes, the next figure plots the average change in credit score (specifically the FICO® Score 8 credit score) between December 2022 and June 2023 for consumers who had medical collections tradelines on their credit records in December2022 (credit scores in the CCP are only available quarterly). Again, each point represents a group of consumers with the same largest medical collections tradeline balance in December 2022. Because, like other recent FICO Score models, the FICO® Score 8 model disregards collections tradelines below $100 , the figure is limited to consumers whose largest medical collections tradeline balance was at least $100 in December 2022.

All consumers with medical collections in December saw improved credit scores on average over the 6 months from December 2022 to June 2023, but credit scores rose about 20 points more for consumers whose largest medical collections tradeline was just under $500, compared to those whose largest medical collections tradeline was just over $500. About 37 percent of consumers whose largest medical collection tradeline in December 2022 had an initial balance less than $500 had their FICO Score increase enough to put them in a higher score tier, compared to about 24 percent of consumers whose largest medical collections tradeline in December 2022 had initial balance greater than $500.

To some extent these results are specific to the credit score used here, and we might expect different changes using other credit scoring models . The credit score that financial institutions use for credit decisions may differ from the FICO Score used here, which in turn may also differ from the scores provided to consumers through their banks or financial management apps.

Figure 2: Average change in FICO Score between December 2022 and June 2023, by amount of largest initial reported medical collections tradeline in December 2022.

Source: CFPB Consumer Credit Panel

Credit-seeking behavior hasn’t changed

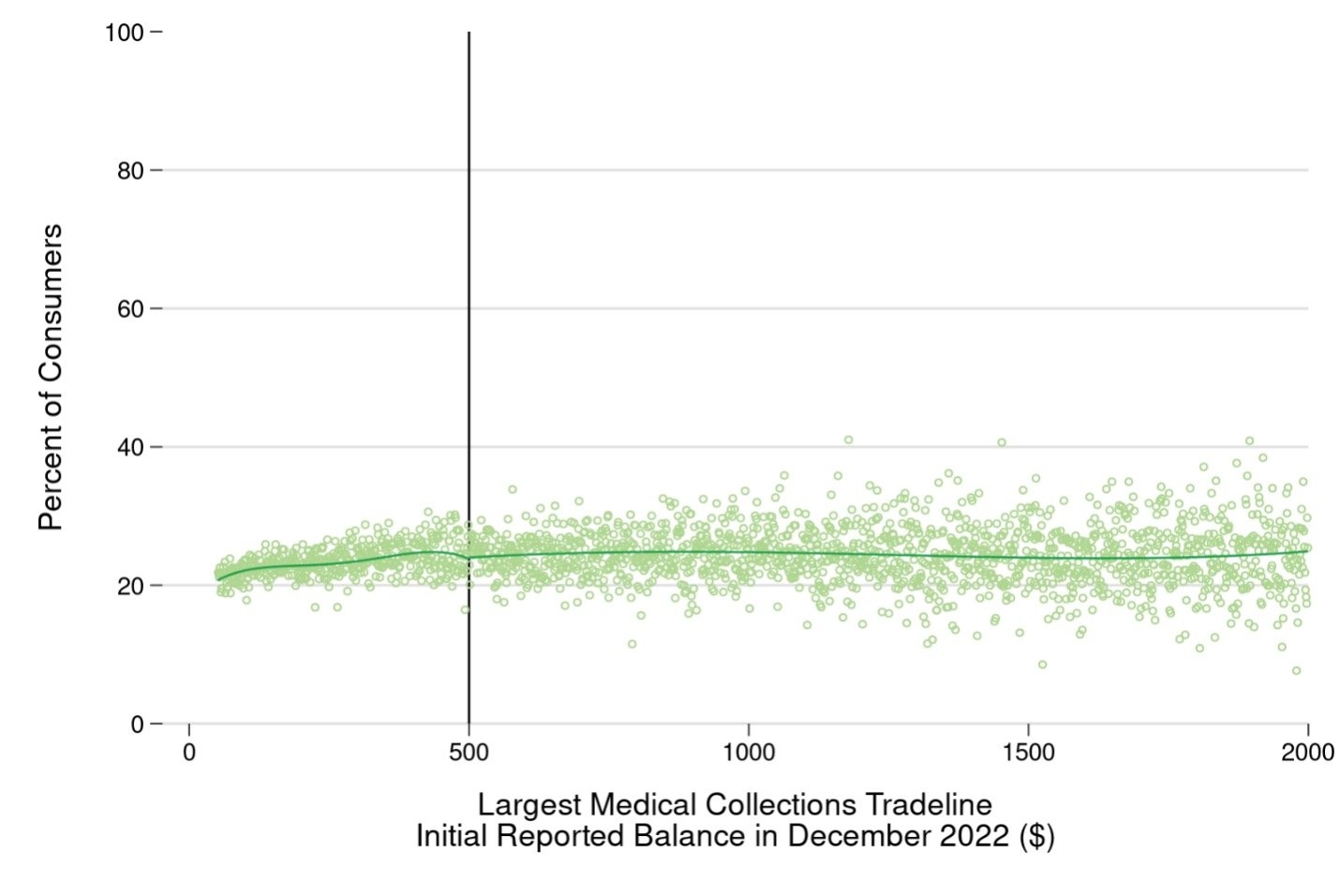

We also examine whether consumers whose credit scores have improved due to the reporting changes are seeking more credit. The CCP contains records of “hard” credit inquiries, generated when a consumer applies for a new credit account. To the extent that consumers realize that their FICO Scores have improved and think they are more likely to be approved for credit than before, we might expect them to be more likely to apply for credit, and for more inquiries to appear in the CCP data. The figure below plots the share of consumers with at least one credit-related inquiry at the national consumer reporting agency our data come from between April 2023 (the month after all the reporting changes went into effect) through August 2023 (the latest month we have data for). Again, each point represents a group of consumers with the same largest initial balance amount on their medical collections tradelines in December 2022. About 25 percent of consumers with a medical collections tradeline in December 2022 had an inquiry for a new account between April 2023 and August 2023, but there is no meaningful difference between consumers whose largest medical collection was just below or just above $500.

Figure 3: Share of consumers who had at least one hard inquiry for credit between April 2023 and August 2023, by amount of largest initial reported medical collections tradeline in December 2022.

Source: CFPB Consumer Credit Panel

Conclusion

The recent move by the credit reporting companies to remove certain medical collections information from consumers’ credit records has improved the credit scores of a number of consumers. A majority of medical collections balances still remain on credit records. This analysis shows that the effect on scores was notably larger for those who had all medical collections removed compared to consumers with at least one collection with a balance greater than $500, the threshold for one of the removal criteria. At the same time, the reporting of medical collections tradelines on consumer credit reports remains inconsistent, with medical collections frequently being removed shortly after they are first added, independent of the reporting changes. Given how many consumers had an unpaid medical collections tradeline above $500 prior to the changes and nonetheless had no medical collections after the changes, a large share of consumers who had medical collections prior to the reporting changes would likely have had those medical collections removed without the changes. Conversely, many consumers whose medical collections tradelines prior to the changes met the credit reporting companies’ criteria for removal continued to have new medical collections tradelines added that do not meet the criteria for removal. However, given prior trends showing that medical collections tradelines often drop off quickly for no obvious reason, we anticipate that many of those new collections tradelines will likely drop off before long. Prior CFPB work concluded that medical collections tradelines are less predictive of future default than other types of collections tradelines. However, the inconsistency in whether and how long medical collections tradelines are reported makes it unclear whether medical collections tradelines, or the lack thereof, provide any clear signal to creditors about which consumers have medical debts, much less whether a consumer has the ability to repay future obligations on time.