On your side through life’s financial moments

- English

- 中文

- Tiếng Việt

- 한국어

- Tagalog

- Pусский

- العربية

- Kreyòl Ayisyen

The CFPB is on your side

We’re the Consumer Financial Protection Bureau, a U.S. government agency dedicated to making sure you are treated fairly by banks, lenders and other financial institutions.

Money topics and key terms

Browse by money topic to find answers to commonly-asked financial questions. Learn the basics, understand key terms, and find ways to take action when you have an issue.

Submit a complaint about a financial product or service

Each week we send more than 10,000 complaints about financial products and services to companies for response. If another agency would be better able to assist, we’ll send it to them and let you know. Most companies respond within 15 days.

See how the complaint process works

Watch this short video to find out what to include in your complaint and what will happen after you submit.

How to submit your complaint

- Online (in English)

- Or by phone at (855) 411-2372 for help in English, and 180 other languages. Calls are usually answered in less than 1 minute. Your complaint will be translated to English and sent to the company for response. When the company responds, they typically do so in English, but you can call us to hear a translated response.

Find answers before you start a complaint

Testimonials

Below are stories of how people like you were helped by the CFPB's submit a complaint process. You speaking up gives us important insight into the issues you face as a consumer.

“I can’t even tell you the number of times I’ve cried over my finances. I contacted the CFPB because I really needed someone else on my side. There’s nothing that I was doing with this private student loan service that was changing anything, and I was stuck in a position that felt hopeless to me. So, for me, it was all about finding someone that could actually make a difference … anytime I hear about people having trouble with other issues, I definitely point them in the direction of the CFPB.”

– Dani

"I lost an apartment because of the bankruptcy still showing in my credit. After the ten years when the bankruptcy was supposed to be gone, I tried again for another apartment but before applying I wanted to make sure it was gone and it was still there. So I contacted them. I emailed them. I made several phone calls and they were not taking care of the issue … I thought about contacting the Better Business Bureau and they told me I should call the CFPB, and I was like let me try and I called and I was really surprised how quickly they took care of the issue. Within two weeks, everything was finalized, like a letter saying its gone and everything has been resolved from both parties. I like that there is a government agency at the federal level like the CFPB that will respond and will protect us consumers from, sometimes abusive behavior from financial institutions."

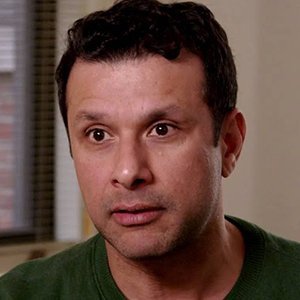

– Jorge