Civil Penalty Fund

In the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, Congress established a victims relief fund, called the Civil Penalty Fund, to provide money to people who have been harmed by companies that break federal consumer financial protection laws.

About the Fund

When the CFPB takes legal action against a person or company for breaking the law, they may be required to pay money into our Civil Penalty Fund, which is used to help compensate harmed victims who wouldn’t otherwise receive compensation from the defendant in the case.

Our work

Payments to harmed consumers

The CFPB takes action against companies and individuals who have broken consumer financial protection laws. If you’ve been harmed, you might be eligible to receive a payment through the Civil Penalty Fund.

Governance

The fund is managed by an administrator who reports to the CFPB’s Chief Financial Officer. The administrator is advised by a governance board and the rule that applies to the fund. The administrator assesses which people will receive money and how much they’ll receive. The administrator also supervises the payments.

Allocation schedule

Every six months, the fund administrator sets aside money for payments to harmed consumers. The administrator can also direct money to consumer education and financial literacy programs.

Consumer education & financial literacy

When all eligible harmed consumers have received full compensation, or when it’s not feasible to make payments to consumers, the CFPB can use Civil Penalty Fund money for consumer education and financial literacy programs.

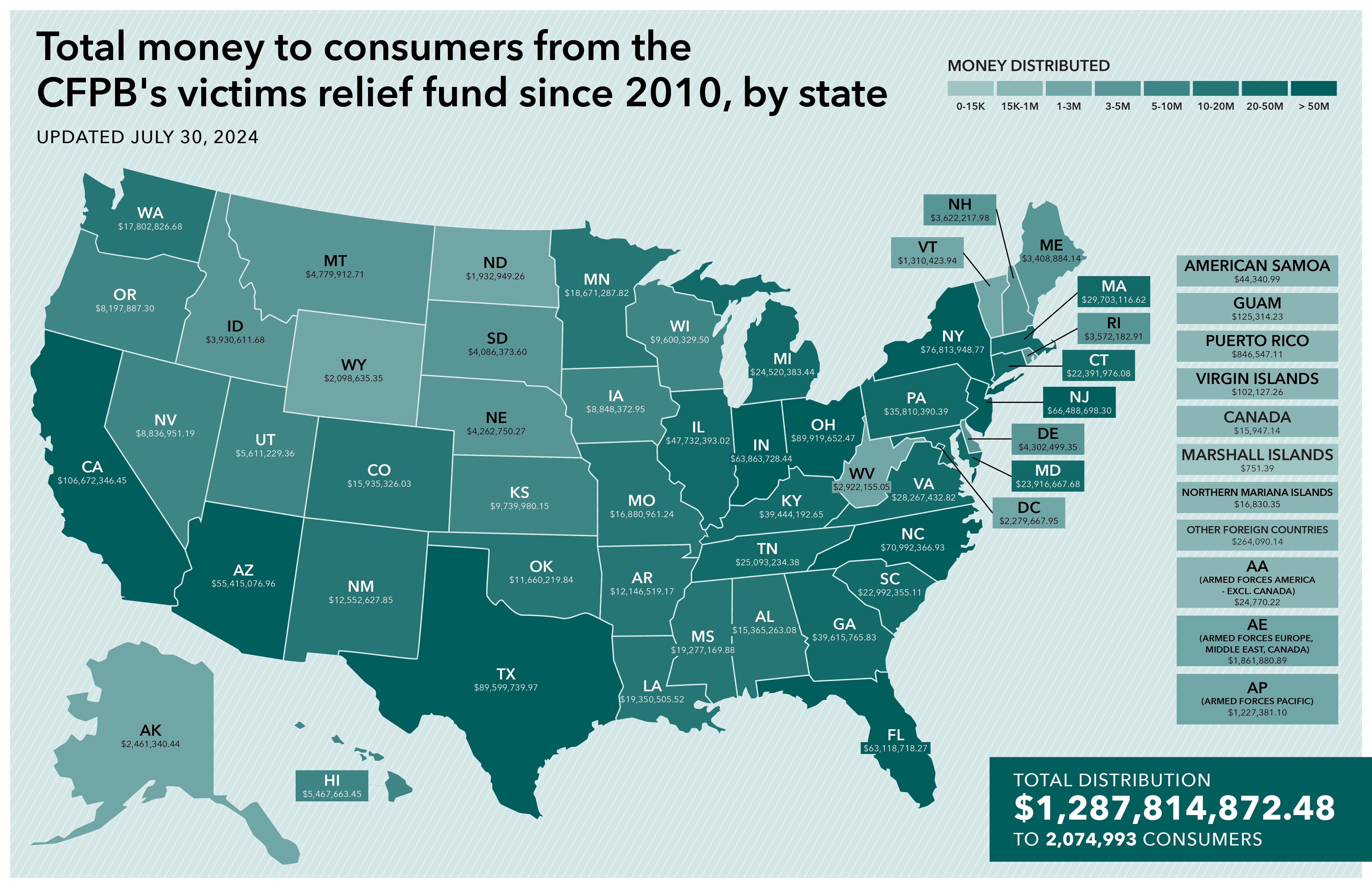

Civil Penalty Fund by the numbers (since 2010)

Last updated 7/30/24